There’s a quiet shift happening within the ATO, and it’s catching a lot of businesses off guard.

It’s called the Tax Gap Program, and it sounds like something out of a cheery government initiative catalogue. But don’t be fooled by the branding - there’s nothing fun or optional about it. The ATO is using its newly enhanced Risk Engine, now powered by artificial intelligence, to comb through business financials with greater speed, accuracy, and scrutiny than ever before.

Whether you operate as a sole trader, run a company, trust or partnership - or even have a Self-Managed Super Fund - you are not exempt from review. And while we haven’t yet had a Tax Gap audit land at SMART Business Solutions, our national network of accountants has. They’ve shared real examples, so we can prepare our clients before the ATO comes knocking.

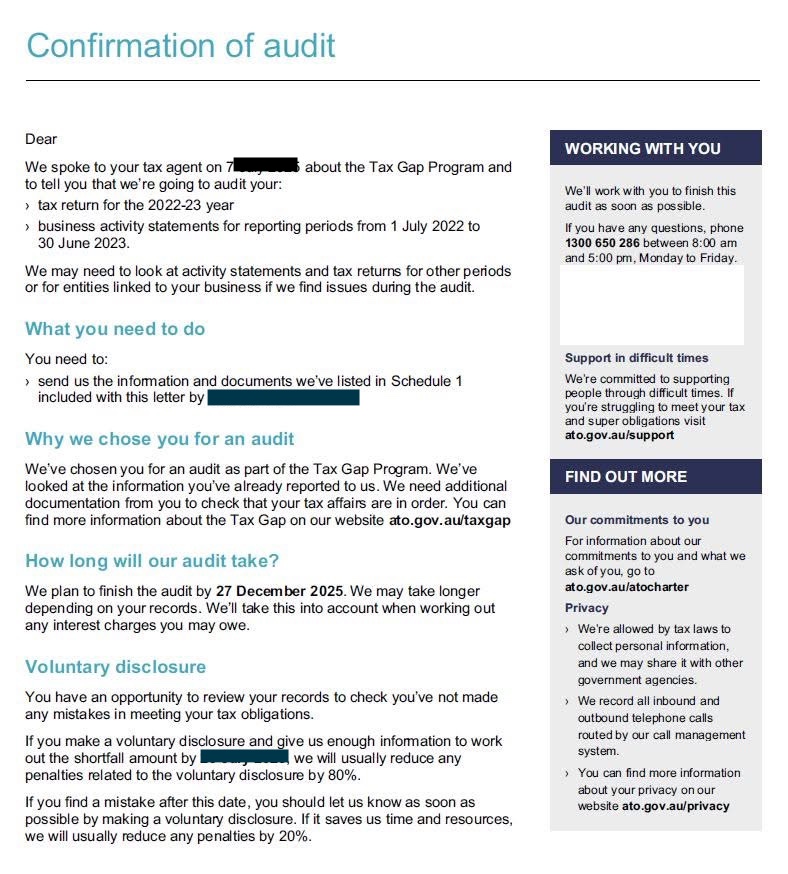

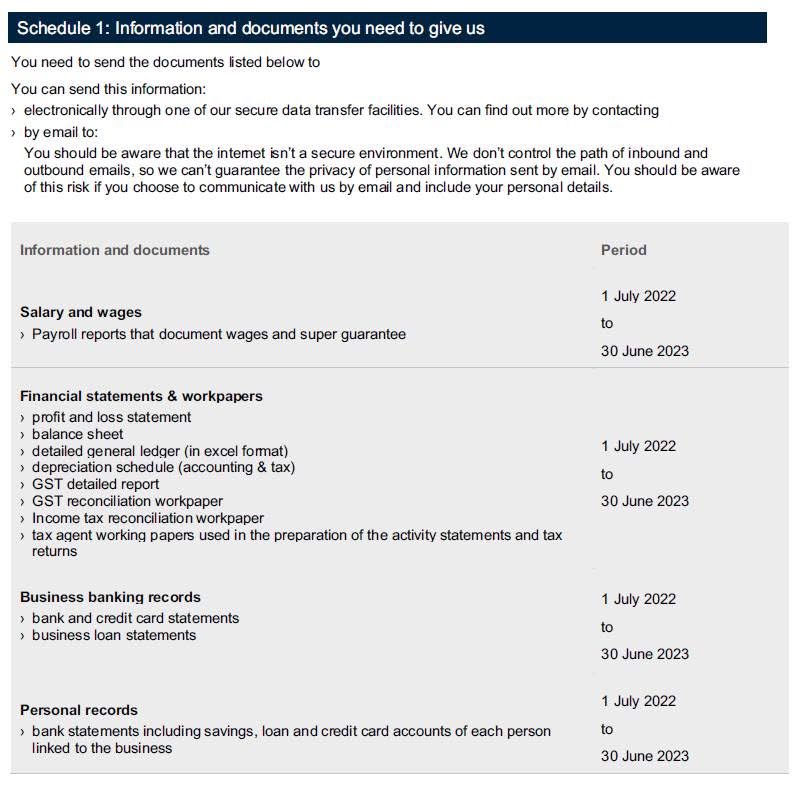

Example: ATO Tax Gap Program - Confirmation of Audit letter

Even if you’re doing everything right, audits can still happen. The Tax Gap Program isn't just targeting the dodgy operators. In fact, many businesses selected have done nothing wrong at all. But once the ATO begins an audit, the process itself can be costly.

We're talking thousands of dollars in professional time - even if you're fully compliant. That’s why we strongly recommend our Audit Management Service. This cover acts like insurance for audits. It reimburses you for the professional fees involved with managing an audit - including our time, external specialists like tax lawyers, and any compliance work that needs to be done. It applies across all your business entities, and yes - it’s tax-deductible.

You can view the full brochure and details of what’s covered here.

In practical terms, this means if you’re audited, you're not left footing a hefty bill for something outside your control. Like any

insurance, you hope you’ll never need it - but if you do, you’ll be incredibly glad it’s there.

If there’s one takeaway from this, let it be this: Don’t try to run non-business expenses through your business. The ATO is watching. Their AI is learning. And the cost of being caught isn’t just financial - it’s time, energy, and stress you don’t need. Be honest. Be clean. And let us help you stay ahead of the curve.

If you’re unsure about an expense, ask us. If you haven’t yet taken out Audit Protection, talk to us about adding it to your support package.

We're here to empower you to make smarter business decisions.

Covering your professional fees in the event of an audit.

On 31 March, the Fringe Benefits Tax (FBT) year ends. With the ever increasing budget deficits, the ATO will be reviewing whether all employers who should be paying FBT are, and that they are paying the right amount. Who needs to lodge a FBT return? Find out here.

If you’re a director of a small business, Payday Super isn’t just an HR or payroll issue. It’s a governance issue that could directly affect your personal legal exposure.