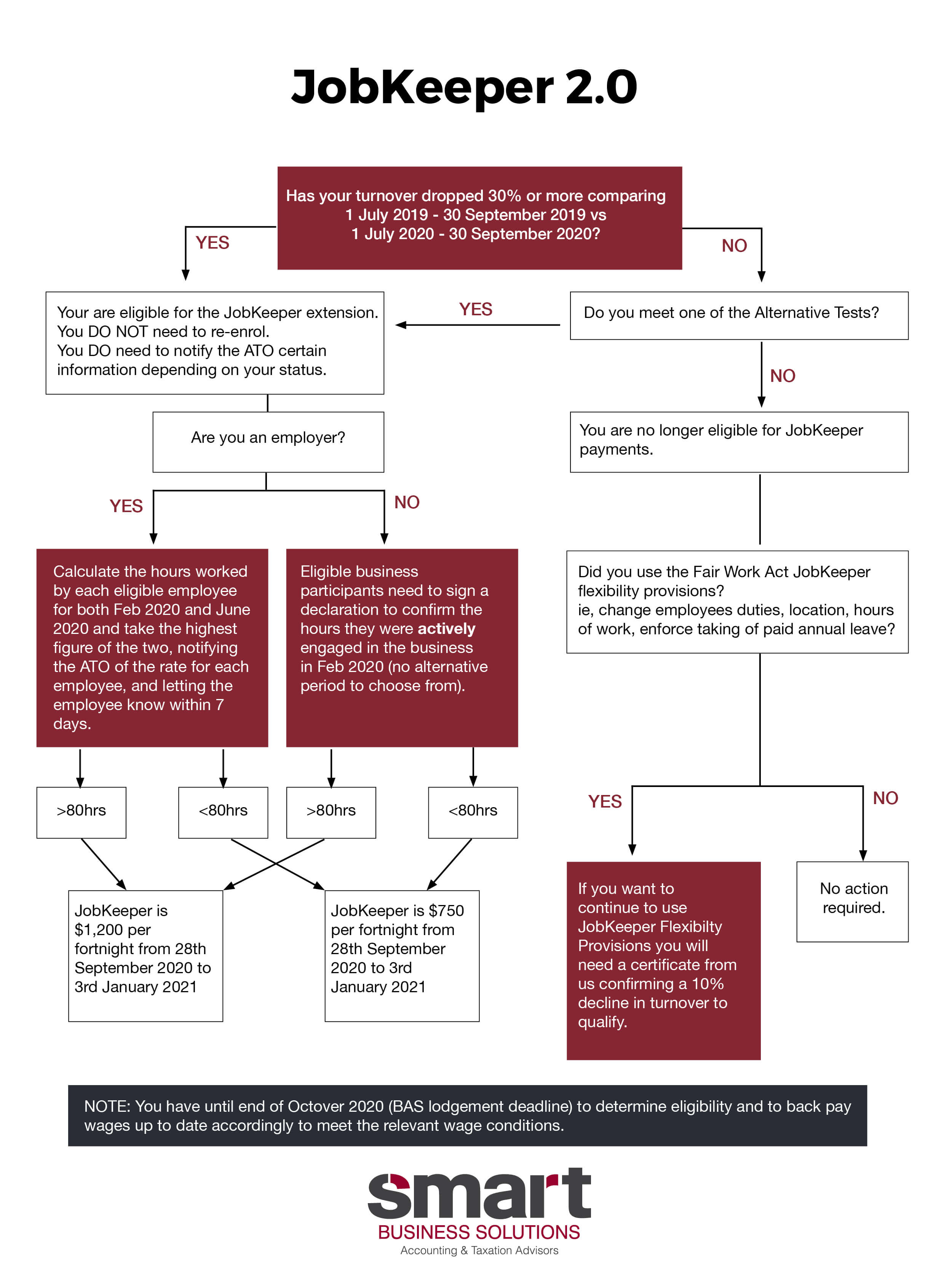

To access JobKeeper payments from 28 September 2020, there are three questions that need to be assessed:

We’ve summarised the key details in this update.

NOTE: Click here for details on the Alternative Tests.

To maximise your deductions and ensure that your tax return is complete, please review the following items and advise your Accountant if any apply to you.

Understand what expenses you can claim as a property investor.

Building on the findings from Xero Small Business Insights (XSBI) report, Small business productivity: Trends, implications and strategies, this special report presents industry and regional labour productivity data for small businesses.

The main residence exemption exempts your family home from capital gains tax (CGT) when you dispose of it.