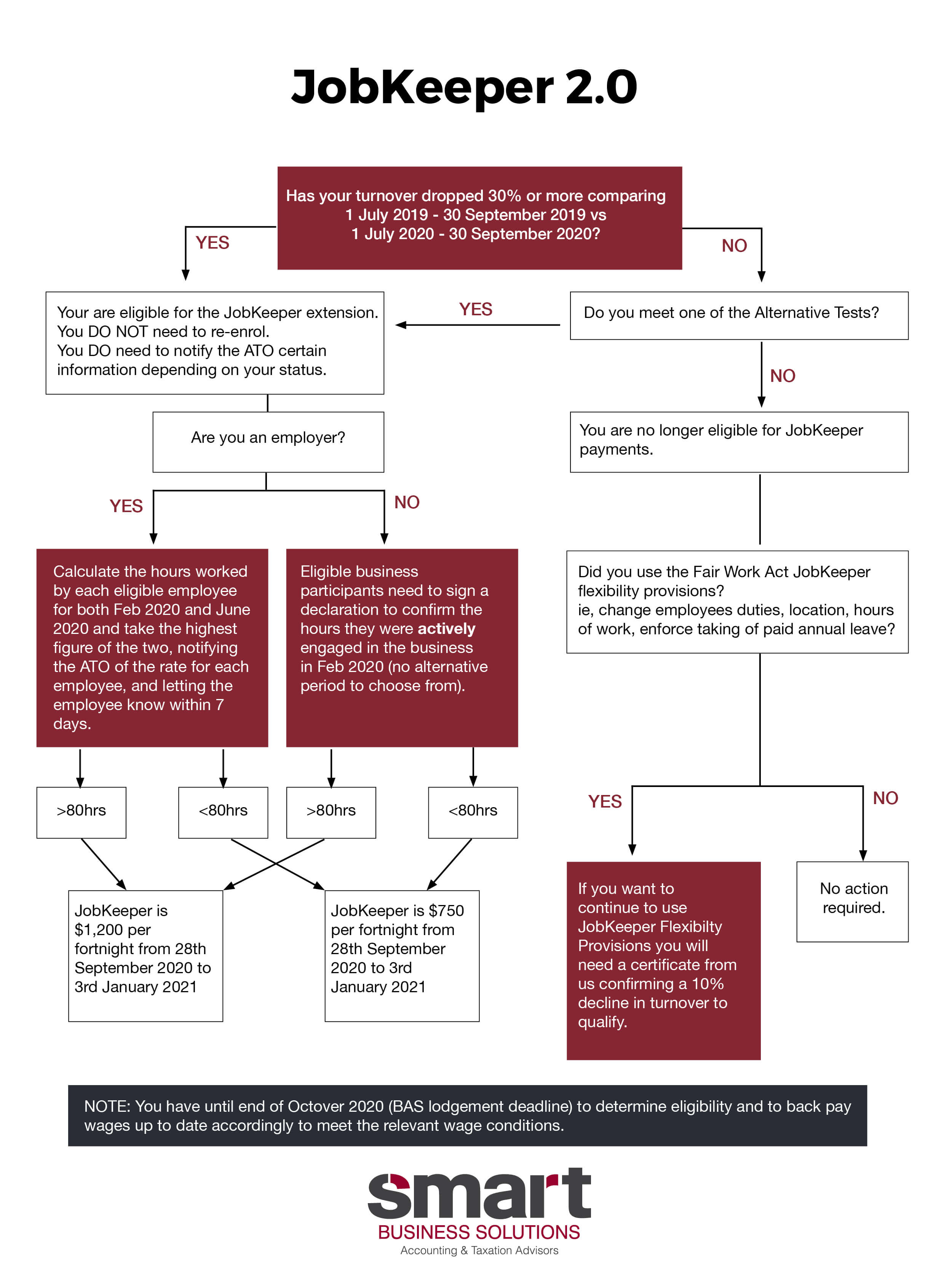

To access JobKeeper payments from 28 September 2020, there are three questions that need to be assessed:

We’ve summarised the key details in this update.

NOTE: Click here for details on the Alternative Tests.

To maximise your deductions and ensure that your tax return is complete, please review the following items and advise your Accountant if any apply to you.

Understand what expenses you can claim as a property investor.

Everyone wants to pay less tax, right? To do that you need to know what you can claim… and what you can’t.

Excellence in Inclusivity and Accessibility recognises businesses for their leadership in creating welcoming, inclusive spaces and ensuring accessibility for all. In this episode, the award-winnings share how inclusion isn’t just the right thing to do - it’s a smart business move.

The Local Community Connection Award recognises businesses with a commitment to strengthening the Mornington Peninsula community through networks, partnerships and social contributions. This episode features the award-winners as they share practical strategies, proven approaches, and inspiring stories that show how community connection isn’t just good for people - it’s sound business practice.