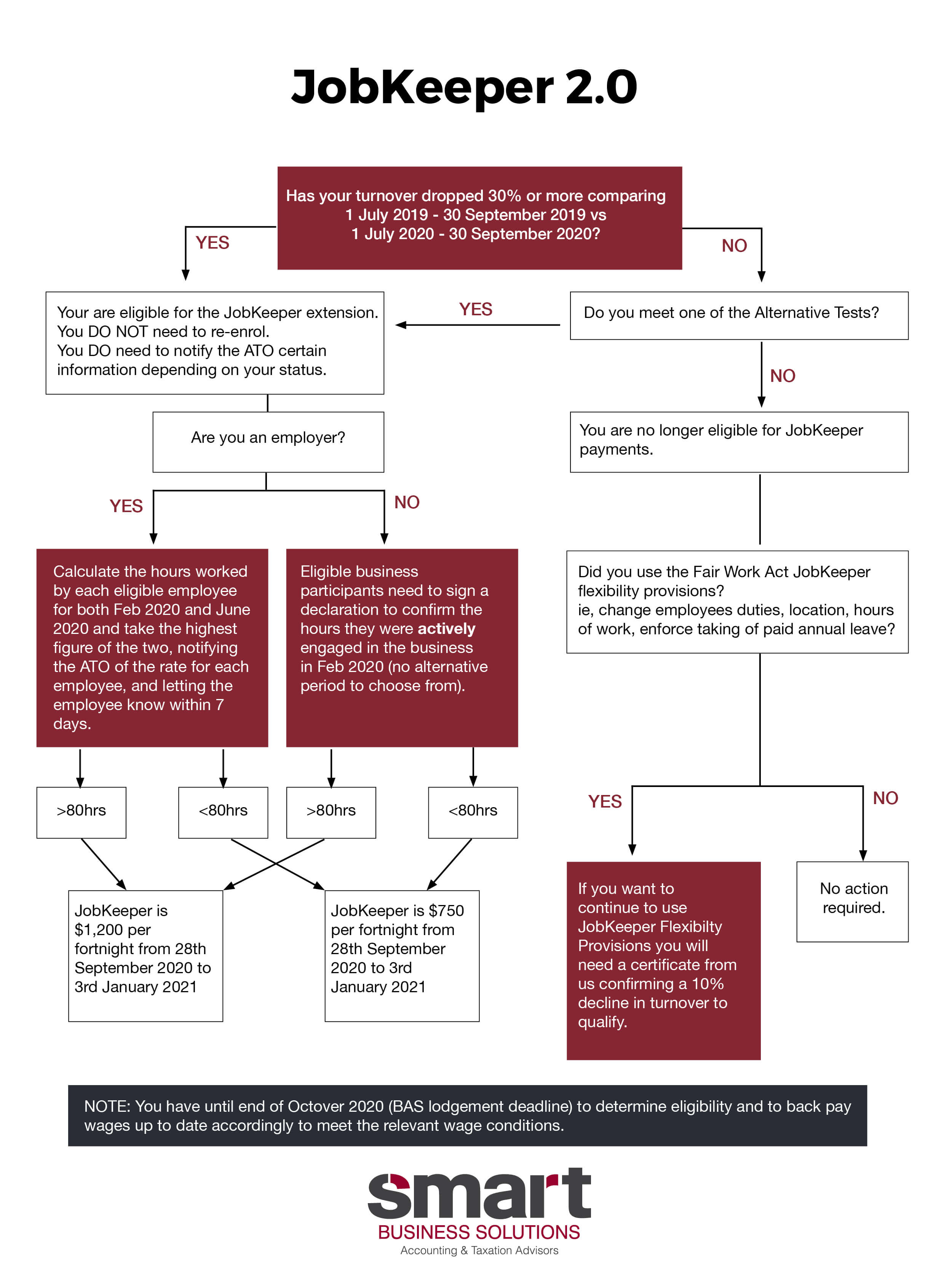

To access JobKeeper payments from 28 September 2020, there are three questions that need to be assessed:

We’ve summarised the key details in this update.

NOTE: Click here for details on the Alternative Tests.

To maximise your deductions and ensure that your tax return is complete, please review the following items and advise your Accountant if any apply to you.

Understand what expenses you can claim as a property investor.

On 31 March, the Fringe Benefits Tax (FBT) year ends. With the ever increasing budget deficits, the ATO will be reviewing whether all employers who should be paying FBT are, and that they are paying the right amount. Who needs to lodge a FBT return? Find out here.

If you’re a director of a small business, Payday Super isn’t just an HR or payroll issue. It’s a governance issue that could directly affect your personal legal exposure.