One of the advantages of self-managed super funds (SMSFs) is the ability to acquire a business real property (BRP), such as a commercial property, a shop or even a farm through your SMSF. The property can then be leased back to a member to use in a business. This hand guide gives you the information you need to know about transferring ownership of a business premises to your SMSF.

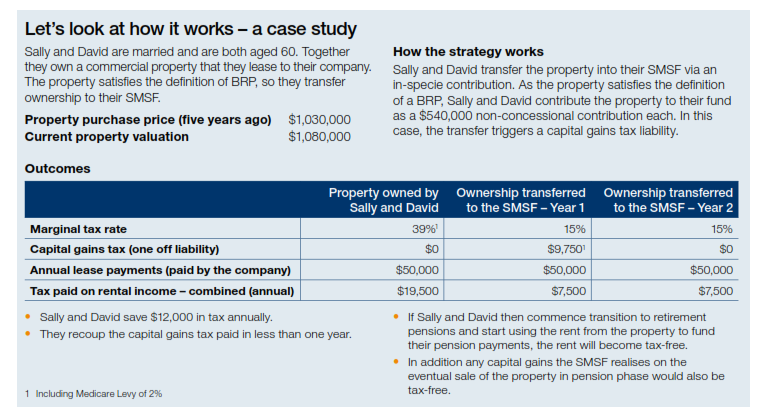

Capital gains tax may have to be paid when the property is transferred to the SMSF. Concessions do apply for small businesses that can reduce any capital gains tax due. Speak to your financial or tax adviser for more information.

There are a number of areas that should be considered before transferring business premises to an SMSF. The checklist below is a good starting point. However, we recommend you also speak with your financial and/or tax adviser.

Types of property that qualify as business real property (BRP):

BRP includes any freehold or leasehold interest in real property (i.e. Land and any buildings permanently attached to the land) where the property is used wholly and exclusively in one or more businesses.

Examples of BRP included:

Investment strategy and trust deed

Establish whether purchasing the property is allowed the SMSF’s trust deed and that it’s appropriate for the fund given its investment objectives, risk profile and liquidity requirements. Trustees may need to engage a lawyer and a financial adviser to confirm this.

Borrowing to acquire the property

Under the limited recourse borrowing rules a trustee of an SMSF may be permitted to borrow to acquire an asset. However, these rules are complex and require specific structures and agreements to be put in place. It’s important to seek specialist financial advice before entering into any superannuation borrowing arrangements.

Arm’s length valuation

An SMSF is only permitted to purchase a business property from a related party (such as a member of the SMSF) for its market value. Trustees may need to obtain an independent professional valuation prior to transferring a business property to their fund to remove any uncertainty about the validity of the property value. Where a business property is then leased back to a member or other related party of the SMSF, the lease must be on an arm’s length basis.

Costs, duties and taxes

Transferring and holding a BRP in an SMSF may incur a number of costs, duties and taxes, including:

Asset can’t be used as security for a loan

The superannuation investment rules generally prohibit any asset of the SMSF being used as security for a loan. Once a property has been transferred into an SMSF it can’t be used as security for any loans taken out by a member or other related party.

Estate Planning

In the event of a member’s death, the trustees may be required to sell SMSF assets in order to pay a death benefit to a member’s beneficiaries. In this situation, tax may apply to both the assets of the SMSF as well as the death benefit payment.

Want to grow your business & improve cash flow?

You need SMART solutions for YOUR business, not just annual tax compliance! Get the SMART team working with you. Call SMART Business Solutions today on 03 5911 7000.

Discover 9 essential financial planning tips to help new and expecting parents manage the costs of parenthood with confidence and ease.

The Taxable Payments Annual Report (TPAR) is a mandatory report for Australian businesses in certain industries to disclose contractor payments to the ATO by August 28 each year, ensuring accurate tax reporting.

Starting July 1st, 2024, non-profit organisations (NFPs) in Australia with an ABN, but not recognised as charitable, must annually submit a NFP self-review return to the ATO to confirm their tax exemption status. This process involves three main sections: