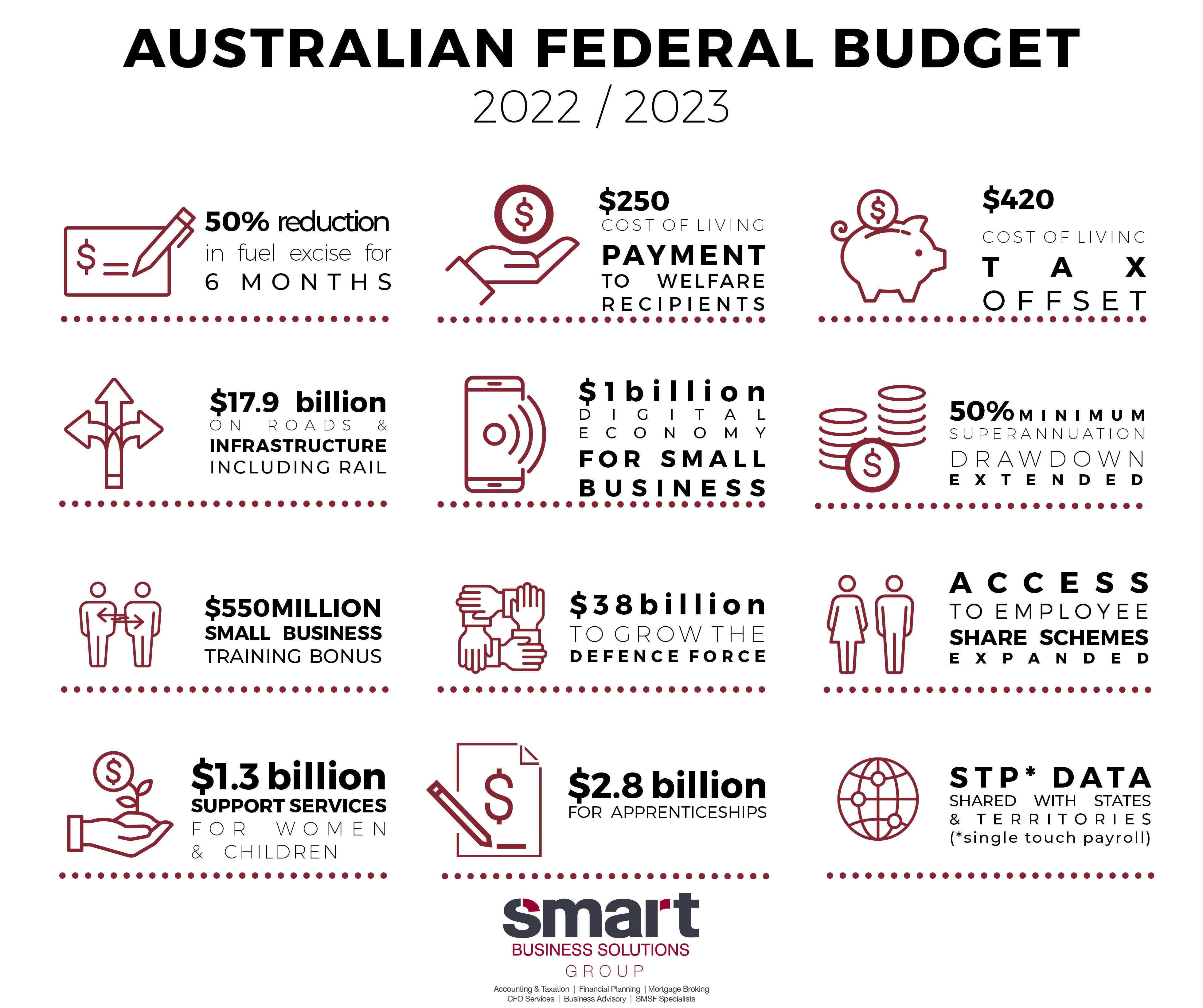

The 2022/23 Federal Budget is a safe, ballot box friendly Budget as expected with a focus on jobs, cost of living, home ownership,

and health.

It is a Budget that drives digitisation. Not just to support innovation but to streamline compliance, create transparency and more readily identify anomalies. Single touch payroll was the first step, the PAYG instalment system, trust compliance, and payments to contractors are next.

The first iteration of the plan had three stages.

The centrepiece of Stage 1 is the Low and Middle Income Tax Offset (LMITO or ‘Lamington’). The Lamington cuts taxes for taxpayers who earn less than $126,000 a year (the vast majority). Taxpayers receive this as a lump sum when they file their tax returns at the end of each financial year.

Beyond compliance, there is an opportunity to capitalise on the benefits of the Government’s push towards innovation and investment in

new technology. Not just the $120 tax deduction for every $100 spent on training employees and digital adoption, but also the expansion of

the patent box tax concessions. There are opportunities for those pushing boundaries.

Our team are here to help. get in touch for any queries you may have on how the Budget may affect you and your business.

To be eligible to make a downsizer contribution to your super, you must be aged 55 or older and have owned your home for at least 10 years prior to the sale.

The investment market volatility that kicked off in March 2025 has felt like a punch, particularly for those in or nearing retirement.