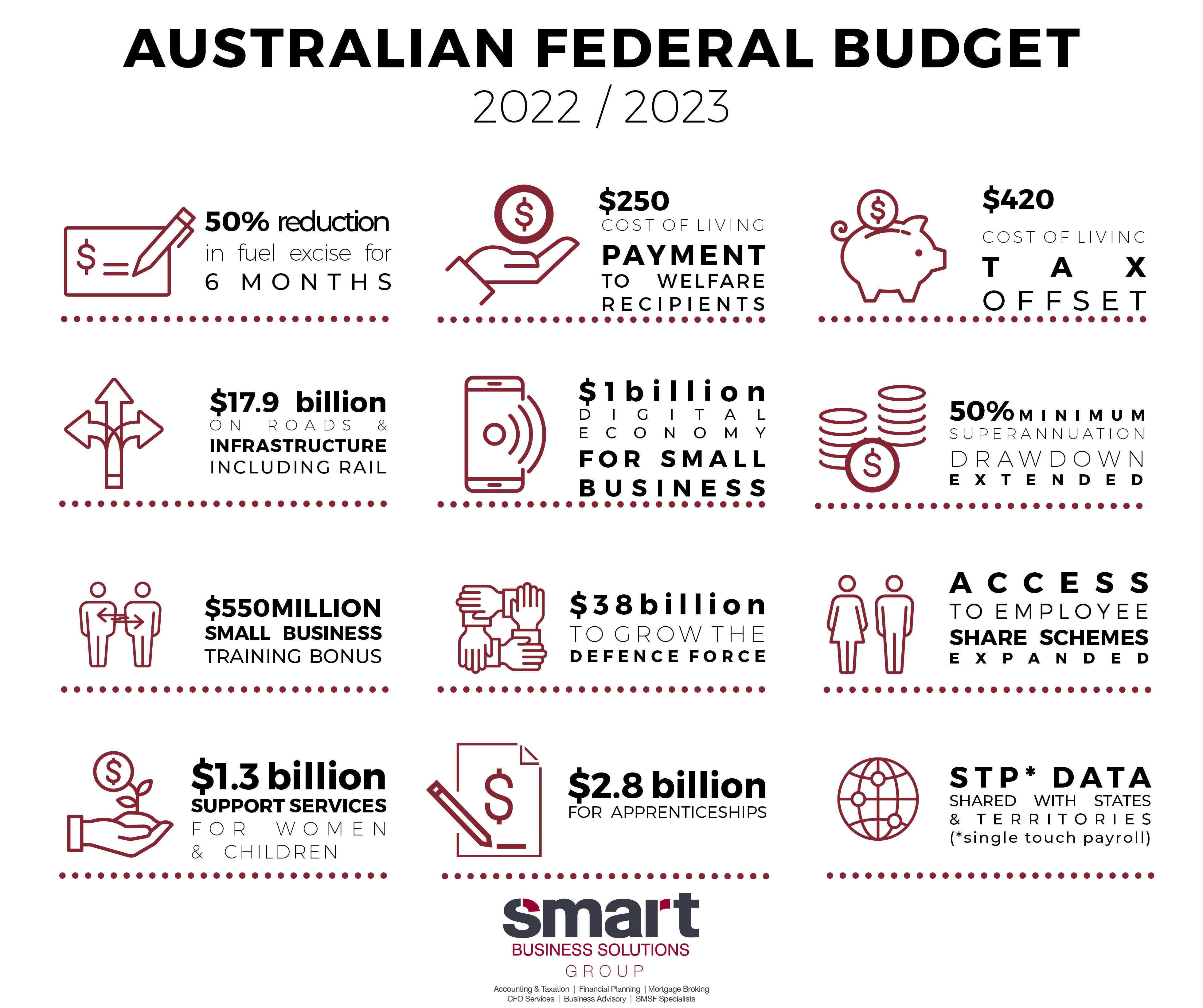

The 2022/23 Federal Budget is a safe, ballot box friendly Budget as expected with a focus on jobs, cost of living, home ownership,

and health.

It is a Budget that drives digitisation. Not just to support innovation but to streamline compliance, create transparency and more readily identify anomalies. Single touch payroll was the first step, the PAYG instalment system, trust compliance, and payments to contractors are next.

The first iteration of the plan had three stages.

The centrepiece of Stage 1 is the Low and Middle Income Tax Offset (LMITO or ‘Lamington’). The Lamington cuts taxes for taxpayers who earn less than $126,000 a year (the vast majority). Taxpayers receive this as a lump sum when they file their tax returns at the end of each financial year.

Beyond compliance, there is an opportunity to capitalise on the benefits of the Government’s push towards innovation and investment in

new technology. Not just the $120 tax deduction for every $100 spent on training employees and digital adoption, but also the expansion of

the patent box tax concessions. There are opportunities for those pushing boundaries.

Our team are here to help. get in touch for any queries you may have on how the Budget may affect you and your business.

On 31 March, the Fringe Benefits Tax (FBT) year ends. With the ever increasing budget deficits, the ATO will be reviewing whether all employers who should be paying FBT are, and that they are paying the right amount. Who needs to lodge a FBT return? Find out here.