Updated 17th Aug 2020

Between April to May 2020, JobKeeper was taken up by 920,000 organisations and around 3.5 million individuals – 30% of pre-Coronavirus private sector employment.

There have been a number of Government announcements on JobKeeper that impact on business and employee eligibility.

Employees that previously failed the JobKeeper eligibility test as they were not employed on 1 March 2020, may now be eligible for payments from 3 August 2020 if they were employed on 1 July 2020 (see Eligible employees).

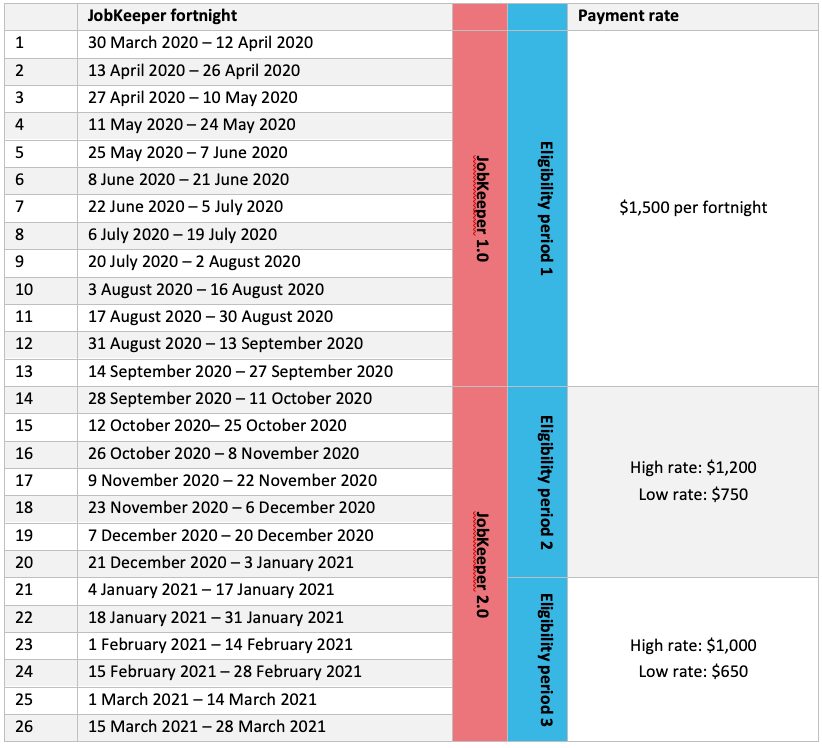

From 28 September 2020, employers seeking to claim JobKeeper payments will need to reassess their eligibility and prove an actual decline in turnover. From this date, the JobKeeper payment rate will reduce and split into a higher and lower rate based on the number of hours the employee worked in the 4 weeks prior to 1 March 2020 or 1 July 2020.

To access JobKeeper payments from 28 September 2020, there are two questions that need to be assessed:

We’ve summarised the key details for employers on JobKeeper 2.0 in this update, but just remember that the proposed changes are not yet

law and the details could still change. Let us know if we can assist you in any way.

From 28 September 2020, the second tranche of the JobKeeper scheme changes the eligibility tests for employers and employees, and the method

and amount paid to eligible employees. Eligibility To receive JobKeeper from 28 September 2020, employers will need to reassess their

eligibility with reference to actual GST turnover for the September 2020 quarter (for JobKeeper payments between 28 September to 3 January

2021), and again for December 2020 quarter (for payments between 4 January 2021 to 28 March 2021).

3.1 Eligible employers

The broad eligibility tests to access JobKeeper remain the same with an extended decline in turnover test.

1 March 2020 is an absolute date. An employer that had ceased trading, commenced after 1 March 2020, or was not pursuing its objectives in Australia at that date, is not eligible.

*Additional tests apply from 28 September 2020.

3.2 Additional decline in turnover tests

To receive JobKeeper payments from 28 September 2020, businesses will need to meet the basic eligibility tests and an extended decline in turnover test based on actual GST turnover.

| |

30 March to 27 September 2020 |

28 September to 3 January 2021 |

4 January 2021 to 28 March 2021 |

| Decline in turnover |

Projected GST turnover for a relevant month or quarter is expected to fall by at least 30% (15% for ACNC-registered charities, 50%

for large businesses) compared to the same period in 2019.* |

Actual GST turnover in the September 2020 quarter (July, August & September) fell

by at least 30% (15% for ACNC-registered charities, 50% for large businesses) compared to the same period in 2019. The decline for the quarter needs to be met to continue receiving JobKeeper payments. |

Actual GST turnover in the December 2020 quarter (October, November & December) fell

by at least 30% (15% for ACNC-registered charities, 50% for large businesses) compared to the same period in 2019. The decline for the

quarter needs to be met to continue receiving JobKeeper payments. |

* Alternative tests potentially apply where a business fails the basic test and does not have a relevant comparison period.

Most businesses will generally use their Business Activity Statement (BAS) reporting to assess eligibility. However, as the BAS deadlines are generally not due until the month after the end of the quarter, eligibility for JobKeeper will need to be assessed in advance of the BAS reporting deadlines to meet the wage condition for eligible employees. However, the ATO will have discretion to extend the time an entity has to pay employees in order to meet the wage condition.

Alternative arrangements are expected to be put in place for businesses and not-for-profits that are not required to lodge a BAS (for

example, if the entity is a member of a GST group).

3.3 Alternative tests

The Commissioner of Taxation will have discretion to set out alternative tests that would establish eligibility in specific circumstances where it is not appropriate to compare actual turnover in a quarter in 2020 with actual turnover in a quarter in 2019. These alternative tests have not as yet been released.

The Government has announced that employee eligibility tests will change from 3 August 2020 onwards.

Under the current version of the JobKeeper scheme an employee must generally have been employed by the relevant entity on 1 March 2020 to be

eligible for JobKeeper payments. Someone employed as a casual on that date also must have been employed on a regular and systematic basis

for the 12 month period leading up to 1 March 2020.

However, these proposed changes mean that employees who were previously ineligible for JobKeeper because they were not employed by the entity on 1 March 2020 may now be able to receive JobKeeper payments if they were employed by the entity on 1 July 2020 and can fulfil all of the other eligibility requirements.

*A ‘long term casual employee’ is a person who has been employed by the business on a regular and systematic basis during the period of

12 months that ended on the applicable testing date (previously 1 March 2020, but changing to 1 July 2020). These are likely to be

employees with a recurring work schedule or a reasonable expectation of ongoing work.

4.1 JobKeeper Payments

From 28 September 2020 the payment rates for JobKeeper will reduce and split into a higher and lower rate.

Whether an eligible employee can access the higher or lower rate will depend on the number of hours they worked during a 4 week test period.

The Government indicates that the higher rate will apply to employees who worked at least 20 hours a week on average in the four weeks of

pay periods prior to either 1 March 2020 or 1 July 2020.

|

JobKeeper |

30 March to 27 September 2020 |

28 September to 3 January 2021 |

4 January 2021 to 28 March 2021 |

|

Payment |

|

|

|

4.2 Assessing if an employee has worked 20 hours or more

JobKeeper payments from 28 September 2020 are paid at a lower rate for employees who worked less than 20 hours per week on average in the four weeks of pay periods before 1 March 2020 and the four weeks of pay periods before 1 July 2020.

The Commissioner of Taxation will have discretion to set out alternative tests for those situations where an

employee’s or business participant’s hours were not usual during February or June 2020. Also, the ATO will provide guidance on how this

will be dealt with when pay periods are not weekly. This guidance is not as yet available.

If your business and your employees passed the original eligibility tests to access JobKeeper, and you have fulfilled your wage

requirements, you can continue to claim JobKeeper up until the last JobKeeper fortnight that ends on 27 September 2020.

ATO Assistant Commissioner Andrew Watson said in a recent interview, “Once you’re in, you’re in to the end of September. If you meet the

eligibility test once, you’re in it for the whole time.” The original eligibility test was a once only test although there are ongoing

conditions that need to be satisfied for each JobKeeper fortnight.

The Government has updated the rules to ensure that 1 July 2020 will be relevant test date (rather than 1 March 2020) from 3 August 2020 onwards, which means that some additional employees might become eligible for JobKeeper from the 10th JobKeeper fortnight onwards.

Employees who met the conditions at 1 March 2020 will continue to be eligible assuming they are still employed by the entity etc. In practical terms this means:

Employers need to ensure that they identify all additional employees who could be eligible for JobKeeper to ensure that they comply with the

"one in, all in" principle and that they meet the nomination requirements.

Crucially, the ATO has announced that the deadline for making payments for new eligible employees for JobKeeper fortnights starting on 3

August 2020 and 17 August 2020 has been extended to 31 August 2020 (ie, to meet the condition for employers to pay at least $1,500 to

eligible employees in each JobKeeper fortnight).

The other key change to the rules is that someone who was previously nominated for JobKeeper with an entity as an eligible employee or eligible business participant can potentially be nominated for JobKeeper with a different entity if certain conditions are met.

The individual must have ceased to be employed or actively engaged in the business (as a business participant) of the original entity after 1 March 2020 but before 1 July 2020.

They must also meet the conditions to be treated as an eligible employee of the new employer at 1 July 2020.

We're assisting our clients with processing their JobKeeper applications. Reach out on 03 5911 7000 if you would like us to help you.

To be eligible to make a downsizer contribution to your super, you must be aged 55 or older and have owned your home for at least 10 years prior to the sale.

The investment market volatility that kicked off in March 2025 has felt like a punch, particularly for those in or nearing retirement.