Since the coronavirus was first detected at the end of 2019 in the Hubei province of mainland China, the world has cautiously watched the

situation as the virus spread to neighbouring nations in Asia and then further abroad. Governments around the world have responded in

various ways to try and contain the spread of the virus, including quarantines on returning international travellers and restrictions on

travel to certain countries like China and Iran.

As at Tuesday, 3 March 2020, there were 33 confirmed cases of coronavirus in Australia, with the first confirmed death sadly recorded earlier in the week.1

Impact on markets

Following an initial correction in early February that the market recovered from, evidence that the incubation period is longer than first understood, coupled with a sharp increase in the number of confirmed infections outside China, gave rise to concern about failure to contain the spread of the coronavirus, which in turn caused extreme market volatility.

US shares fell sharply in the past week, with the S&P recording its biggest weekly fall since the 2008 Global Financial Crisis (GFC). This also marked the fastest ever retreat from an all-time high, recorded earlier in February. As more cases surfaced globally, there was an increased expectation of significant impact to global growth in the short-term at least, which led to the falls we’ve seen.

Outside the US, the Australian market felt the brunt as well, with shares falling 12%. China and Japan also saw falls in a similar range, while Europe dropped 16% as well. The main reason for these shocks is because of the market’s reassessment of the risk of a global pandemic and the resulting impact on global growth. Investors also feared that trade, particularly with China, would be further restricted. China is the world’s largest exporter of goods, and Australia’s number one trade partner.2

On Tuesday, 3 March we saw the ASX rebound as shares rallied – an indication that the market continues to react in extreme fashion to both positive and negative news.

Falls are normal, even without fear of coronavirus

We’ve seen share market corrections occur frequently, sometimes as high as 15%. Last year, we saw a 7% fall in August alone in Australia. What’s compounding the issue at the moment is the emotional aspect, as people are concerned about the broader health implications, particularly for the elderly or those susceptible to respiratory conditions.

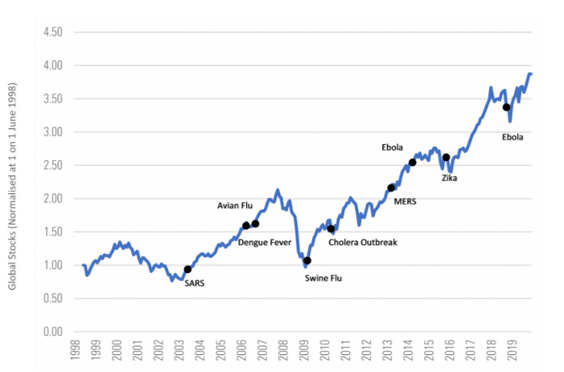

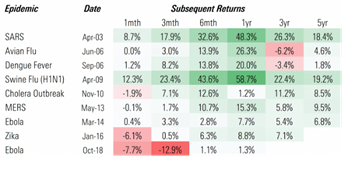

Over time though, we’ve seen that markets are resilient against global epidemics. Even if the immediate impacts cause a temporary fall, the long-term trend is positive:

Source: Morningstar Global Markets GR USD Index, using Morningstar Direct data as at 31 December 2019

The chart below also shows how markets can rebound following some of the major epidemics in recent history:

Source: Morningstar – Coronavirus: An investment perspective

Important considerations

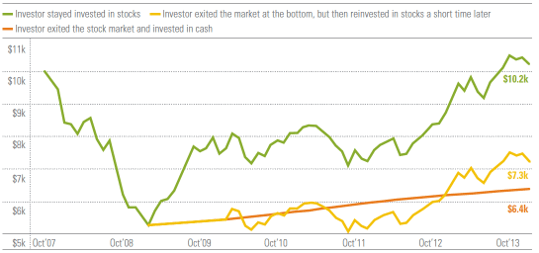

We understand that investors become anxious when superannuation and shares are so heavily impacted in a short space of time. It’s important

to remember that these are long term investments which can fluctuate but historically produce strong returns. Even after significant events

such as the GFC, there is evidence the long-term trends are positive for investors who stayed the course and took advantage of the potential

market upswing:

Source: Morningstar: How to become an emotionally intelligent investor

At the moment, any falls you may have seen are technically only a ‘loss on paper’. However, when the market recovers there’s a chance your investments could return to their pre-fall state. Selling at the ‘bottom of the market’ only serves to crystallise these losses, making them real and irreversible.

How we can help

Your financial plan was designed for you to suit your investment objectives and risk profile. Please feel free to contact us if you have any concerns or questions about the recent volatility we’ve seen in the market and we’ll be happy to assist.

1 https://www.health.gov.au/news/health-alerts/novel-coronavirus-2019-ncov-health-alert

2 https://www.dfat.gov.au/trade/resources/trade-at-a-glance/Documents/index.html

You need SMART solutions for YOUR business, not just annual tax compliance! Get the SMART team working with you. Call SMART Business Solutions today on 03 5911 7000 or reception@smartbusinesssolutions.com.au.

To be eligible to make a downsizer contribution to your super, you must be aged 55 or older and have owned your home for at least 10 years prior to the sale.

The investment market volatility that kicked off in March 2025 has felt like a punch, particularly for those in or nearing retirement.