ATO getting about as serious as they can get with their non-public debt recovery measures. ATO goes into debt

collect overdrive. Businesses will now feel the full force of compliance action by the Tax Office.

Read the full article from Tax Compliance Tony Zhang dated 30th March 2022.

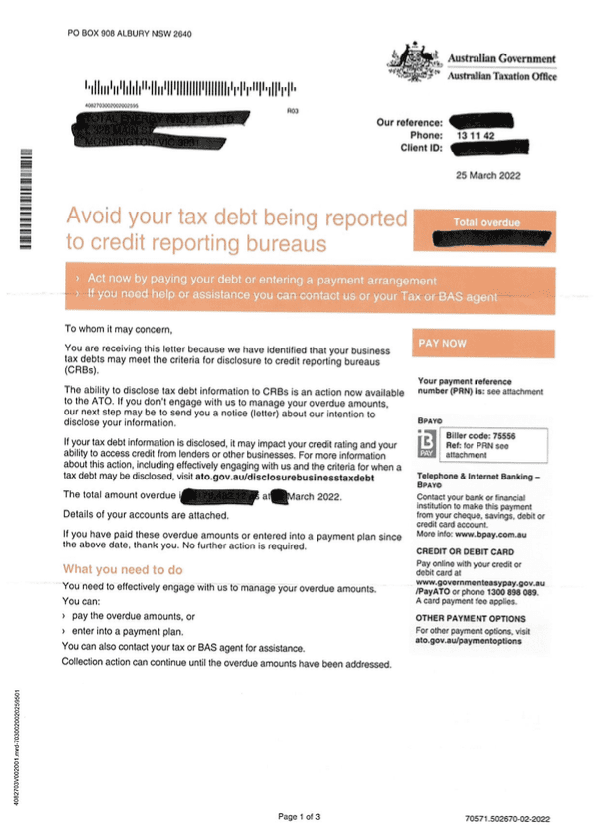

The ATO is writing to all clients eligible to have their tax debts

disclosed to warn that they will be referred to credit reporting bureaus unless they take action. Under the disclosure of business tax

debts measure, if an intent notice says, “Act now or your tax debt will be reported to credit reporting bureaus”, the client has to contact

the ATO within 28 days to prevent disclosure.

“We will then work with you or your client to manage their debt or help them understand the next steps,” the ATO said.

“They can avoid disclosure by making payment in full or negotiating a payment plan.

“If your client does not take steps to actively manage their debt, they will remain eligible for disclosure.”

The ATO said a formal intent to disclose notice would be sent before any disclosure. It said the ATO website contained information for those needing help to pay but it was crucial that a client engaged with the office before the debt became unmanageable.

“You or your client can access our payment plan estimator to work out a plan your client can afford,” the ATO said.

During March, the ATO also wrote to relevant clients to inform them about their potential personal liability for company tax debts under the director penalty notice (DPN) program. The letter had been sent to directors of companies if the company had not met its debt obligations in respect of PAYG withholding, the Superannuation Guarantee Charge and GST.

The ATO said directors would be notified that the Tax Office was considering issuing them with a DPN, which would make them personally liable for the debts of their business if the company did not actively manage their debt.

“Our focus is on making directors aware of their obligations and personal liabilities, and the actions we may take if they don’t engage,” the ATO said.

“We will be providing clear pathways for clients to re-engage, work with us, and avoid escalation.

“Generally, while your client has a debt, general interest charges continue to apply. Encourage your client to bring all their lodgements

up to date to avoid further penalties.”

Building on the findings from Xero Small Business Insights (XSBI) report, Small business productivity: Trends, implications and strategies, this special report presents industry and regional labour productivity data for small businesses.

The main residence exemption exempts your family home from capital gains tax (CGT) when you dispose of it.